• The main challenge for Latin America is ensuring that the growth of the mining sector translates into sustainable and inclusive development.

• Sound fiscal management of the mining sector helps address this challenge by creating opportunities to generate more jobs, improve public services, and build greater capacities for future generations.

• Our new study identifies three major opportunities to strengthen fiscal institutions and increase revenue efficiently, thereby promoting a more competitive, transparent mining industry aligned with sustainable development goals.

Mining is key to global economic development, as it drives technological and industrial progress in sectors such as agriculture, energy, and transportation. Moreover, the revenues generated by the sector, through taxation and royalties, contribute to financing essential infrastructure for the provision of public services.

A key challenge for Latin America is ensuring that mining sector growth drives sustainable and inclusive development. This means moving beyond attracting investment to ensure that mining delivers consistent and meaningful contributions to public finances and improves people’s well-being.

Effective fiscal management plays a critical role in converting underground mineral wealth into long-term development gains. When well designed and properly implemented, mining fiscal regimes can generate quality jobs, strengthen public service provision, and build institutional and economic capacities for future generations. This is precisely the focus of the study: Ideas to Improve Mineral Taxation in Latin America and the Caribbean: Opportunities for Sustainable Development (in Spanish), published by the Inter-American Development Bank (IDB) and the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF).

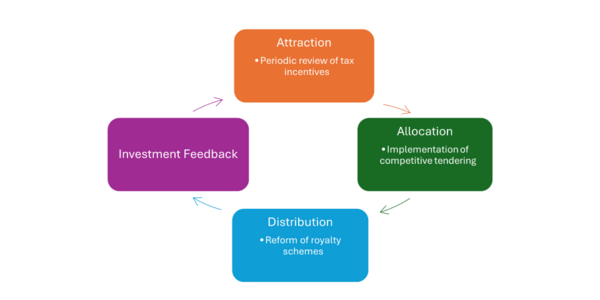

The publication identifies three major opportunities to strengthen fiscal institutions and increase revenue efficiently, thereby promoting a more competitive, transparent mining industry aligned with sustainable development goals. Below are the main recommendations of the study, which form part of an institutional strengthening agenda that both the IDB, through its Fiscal Management Division, and IGF are promoting in the region.

Mining tax incentives aim to attract and promote private investment and develop the sector. To achieve this, governments must properly manage risks and assess the fiscal costs— including administrative costs— of providing such incentives, ensuring they are effective and that the balance between investor benefits and societal benefits is appropriate.

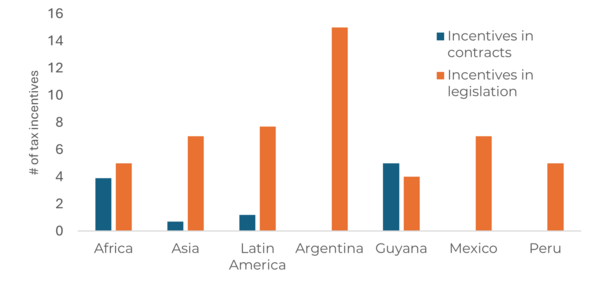

After evaluating the tax structure and incentives offered in Argentina, Guyana, Mexico, and Peru (Figure 2), we found that their impact on tax revenue is significant and therefore deserves detailed analysis to promote greater efficiency and sector development.

Most incentives —such as rate reductions, loss carryforwards, and tax credits— reduce taxation but do not necessarily achieve their main objective of generating additional, sustainable investment. For this reason, we recommend a periodic review and assessment of these incentives to determine their cost-effectiveness, as excessive use compromises resources that could be allocated to development policies, including those that foster innovation, energy transition, and productive infrastructure development.

Attracting investment depends on establishing conditions for participation and competitiveness in the sector, including the allocation of mining licenses. There are multiple allocation methods depending on the level of institutional development: first-come, first-served; public tender; direct negotiation; auction; and administrative allocation, among others (see Table 1).

Table 1. Comparison Between First-Come, First-Served and Competitive Tendering Across Procedural Aspects

First-Come, First-Served | Competitive Tender | |

| Who initiates the process? | The investor | The State |

| Who defines minimum investment terms? | Investor’s proposal | Terms of reference |

| Is there competition among investors? | No competition; the first applicant prevails | Yes, competition among bidders |

| Who holds information on the area to be allocated? | Information subject to availability | Information held by both State and investor |

| Basis for defining contract terms | Investor’s proposal | Terms of reference set by the State |

| Susceptibility to renegotiation | Higher if investor has not defined full scope of mining operation | Lower when State sets minimum conditions for all project phases |

Source: Authors’ compilation based on experiences in Brazil, Colombia, and Suriname

Each method requires different levels of transparency, information, and competition. The most common (and least administratively demanding) method is known as “first-come, first-served.” Under this approach, the State receives an investor’s request to explore and exploit a specific area, for which the investor submits documents detailing the type of investment they can undertake—usually in areas delineated by a geological institute or the ministry of mines.

Through competitive tendering, the State can also collect additional revenues, such as participation fees, award fees or licenses, payments for bidding documents, or financial components within the tender, such as additional economic compensation. These options require the State to prepare terms of reference for investment areas, which demands knowing in advance what products can be extracted and their quality, based on available geological information.

Our research analyzes legislative advances in Brazil, Colombia, and Suriname—countries that have incorporated competitive tendering as a mechanism to allocate licenses for one or more minerals. In these three countries, competitive tendering is not only a natural step toward better sector management and development but also contributes to increasing government revenues. This is achieved by selecting the most cost-efficient projects and generating additional resources through the establishment of fees and economic contributions complementary to mining royalties, which can be set as conditions for participation in bidding rounds.

In Latin America and the Caribbean— similar to countries worldwide—mining royalties are calculated as a fixed percentage of production value or sales (i.e., volume or ad valorem). In a few countries and for certain minerals, such as copper in Chile and Peru, royalties are calculated using a variable and progressive rate based on the operating margin of mining projects.

Progressivity is a key feature of tax systems because it enhances both equity and efficiency. Under a traditional fixed-rate scheme on gross sales value, the state’s share of revenues can distort production and investment decisions, regardless of the business cycle, mineral prices, or production input costs.

Progressive royalty schemes allow governments to capture these variations and maintain a balance between investor interests and social benefits. This is particularly relevant during “super cycles”—periods of significantly high prices. For example, lithium in Chile generated tax revenues exceeding 1.9% of GDP in 2022, compared to less than 0.7% of GDP in previous years.

As a result, it is important to consider moving toward progressive schemes to foster mining competitiveness, promote and protect investment, and generate additional resources to finance new technologies and public policies addressing social and environmental needs.

The region faces challenges in sustainably leveraging the opportunities offered by mining. Advancing toward modern fiscal institutions goes beyond tax design alone: it requires strengthening the State’s capacity to plan, oversee, and manage mining revenues with a strategic, long-term vision.

The three highlighted opportunities are concrete steps toward a more equitable and efficient model—where mineral wealth translates into better schools, hospitals, infrastructure, and quality jobs, supported by public policies that endure beyond price cycles.

Ultimately, strengthening governance and fiscal capacity in the mining sector not only improves revenue collection: it also boosts competitiveness, transparency, and the ability to build a more prosperous and inclusive future for the entire region.

The IDB, through its Fiscal Management Division, and the IGF continue to support countries in the region in strengthening their fiscal institutions, promoting more equitable, sustainable economic development focused on the well-being of citizens.