March 25, 2019

On March 15, more than one million young activists from 125 countries came out to protest with the same message: "It is time to act against the climate crisis". Many adults listened to them and everyday more of us are willing to support green solutions that protect the environment or reduce our carbon footprint.

The challenge? Despite the interest to act quickly to transform our economies into more sustainable ones, for most people it is not easy to identify the companies or organizations they should support in order to have the greatest possible impact.

For example, imagine you organize your co-workers to change your pension fund so that it invests into companies that help fight climate change. Here is where the problem lies: the manager of your pension fund probably would not know where to start. Although there are some listed companies that are dedicated to renewable energies, or that identify themselves as "green" in which they could put money into, what assures them they really are having an impact?

Your pension fund is not the only one that faces this problem. Even the world's largest sovereign wealth funds, which handle billions of dollars, have difficulty identifying a critical mass of companies that are fighting climate change to invest in.

This does not imply that there are no investment opportunities. On the contrary, the gap is so wide that the Financial Initiative of the United Nations Environment Program estimates that the transition to low carbon economies and resilient to climate change will require investments of at least 60 trillion dollars, from now until 2050. As a point of comparison, the value of the entire global economy in 2017 was 81 trillion dollars.

Interactive map: How economically ready is your country to deal with climate change?

Source: Notre Dame Global Adaptation Initiative, 2017.

One option that is showing very promising results to channel more private resources to this objective are green bonds: a fixed income financial instrument whose funds are used exclusively to finance companies or projects that actively contribute to the fight against climate change.

Green bonds work in a similar way to other bonds. A banking institution issues them in the financial market and investors can acquire them as an asset from which they expect to obtain an economic profit.

The big difference is on how those funds are used. With the money they receive from the bonds, financial institutions lend exclusively to a portfolio of projects that are dedicated to positive activities for the environment such as renewable energy, energy efficiency, sustainable agriculture or efficient use of natural resources, among others. In addition, to give greater credibility to the financial market, the bond issuer allows an external agency to conduct an independent review of the conceptual framework of the green bond and its adherence to international standards. This way, investors and banks can measure the magnitude of the environmental impact of the bonds through indicators that are published annually.

"On the matter of sustainable investment, the best way to ensure that what you invest in meets its environmental objectives is through green bonds," says Diego Flaiban, lead investment officer at IDB Invest, the investment arm in the private sector of the IDB Group.

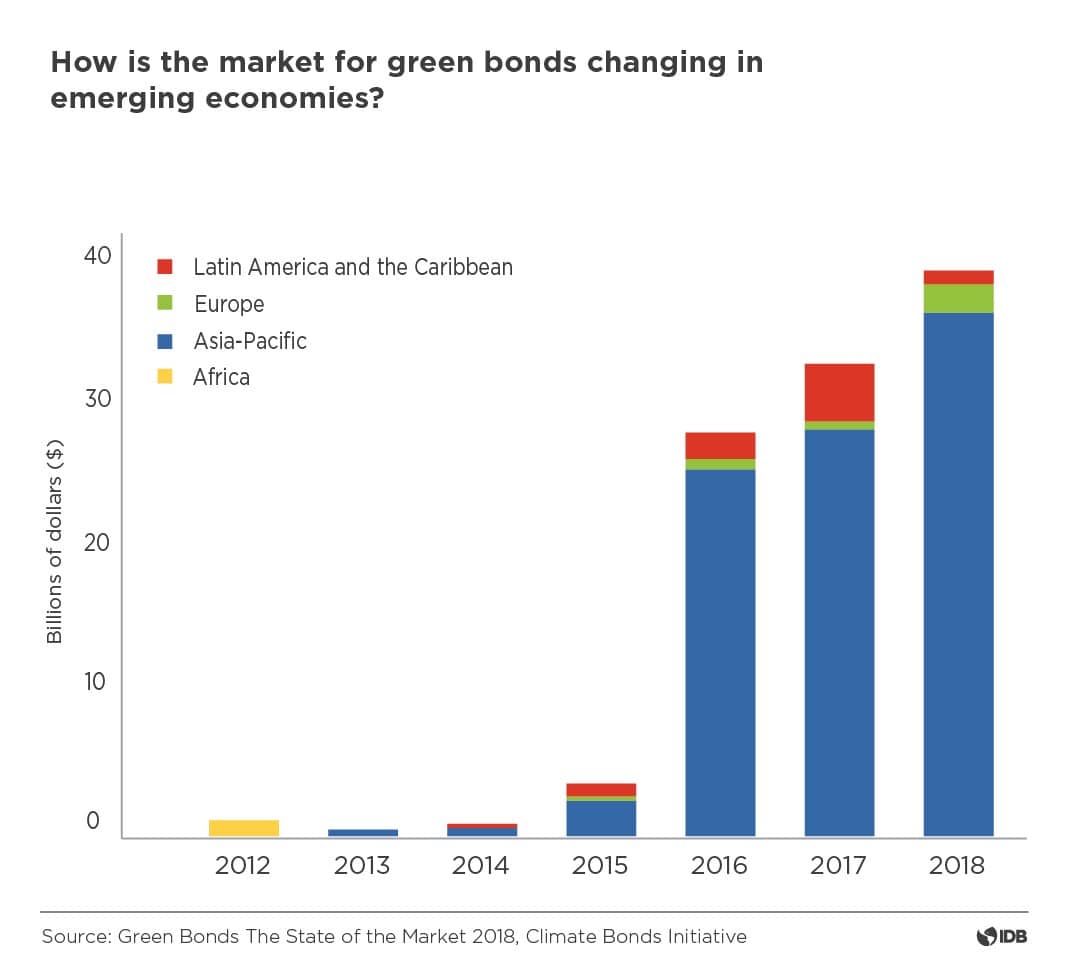

Interest in green bonds has grown exponentially. In 2012, a volume of 3 billion dollars was issued globally; in 2018, the volume increased to 167 billion dollars. The IDB Group has played a critical role in promoting its growth in Latin America and the Caribbean. In the past 5 years, we have supported the development banks of Argentina, Uruguay, Brazil, Colombia, Ecuador, Mexico and Peru to design and issue green bonds in their local markets.

Financial institutions lend exclusively to a portfolio of projects that are dedicated to positive activities for the environment such as renewable energy, energy efficiency, sustainable agriculture or efficient use of natural resources, among others.

"We participated since the starting point, from the structuring until the moment of purchase of the bond", says Sandra Reyes Correa, lead investment officer of IDB Invest. "The IDB's participation is really that of a developer, and a buyer of these bonds. We are in the whole process and we really want to continue promoting them in the region, "she says.

One of the banks we have supported in the past, Bancoldex, recently reported the results of its first green bond. In 2017, they issued them for more than 200 billion Colombian pesos, approximately 64 million dollars at today's exchange rate, in the financial market. With these resources, 273 projects were supported in multiple industries, from renewable energy to sustainable transport projects.

Video: Green bonds in Colombia (in Spanish)

The environmental impact was substantial. With the financing, the companies increased annual energy generation from renewable sources by 99.80 GWh, enough to cover the electricity consumption of 76 thousand people in Colombia. They also reduced the use of 788,277 m3 of natural gas as a fuel source, 360 tons of coal were replaced by other sources of fuel (biomass waste, natural gas, biogas, among others), and overall they decreased by 22,333 tons the amount of CO2 emitted per year. The latter is equivalent to not driving 80 million kilometers in a car.

The success of Bancoldex's first green bond is not an isolated case. We have supported multiple institutions to issue bonds that have achieved a high environmental impact and, based on their positive experience, most have decided to issue more of them in the future. According to our specialists, there is still a lot of growth potential for green bonds in our region and we expect to see a greater evolution in the coming years.

"There is an unmet demand from private investors who want to put their money in sustainable projects," says Diego Flaiban. "Green bonds are here to stay."

You can learn more about green bonds here.