The Board of the IDB Group, in its 2020-2023 Corporate Results Framework, has set the financing related to climate change to an annual floor of 30% for each of its windows, which includes the IDB, IDB Invest and IDB Lab, for the next four years.

In particular, the IDB has set the goal that 65% of its annual project approvals include investments in adaptation and mitigation to climate change; that 100% of projects categorized as high risk include risk analysis and resilience measures by 2023; and that 100% of country strategies take into consideration nationally determined contributions (NDCs) or long-term decarbonization strategies.

IDB Invest, for its part, has established that its accounting will be carried out at the time of financial closure. At the same time, IDB Invest will monitor climate financing in the mobilization of investor resources and will adopt a triple approach to acquire climate capacity: 1) reversal investment; 2) risk management; and 3) transition to a low carbon economy.

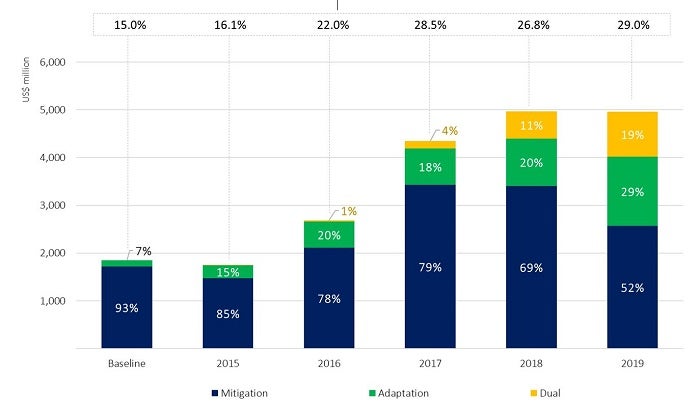

In financial terms, the IDB Group doubled its climate financing in the last four years. In 2019, it achieved a record approval of 29% in climate-related financing, equivalent to US$ 5 billion. This outcome reflects that the IDB Group is incorporating climate change aspects more strategically and systematically into its portfolio, in order to support a low carbon development that is resilient to the impact of climate change.

This climate-related financing has supported investments in renewable energy, electric mobility, sustainable urban development, climate-smart agriculture, and green buildings, as well as capacity building and preparation of natural disaster risk assessments.

Evolution of Climate Finance at the IDB Group

In 2016, the IDB Group set a goal for 30% the total amount approved to be climate-related financing by 2020. Among other results at the regional level, sustained growth in the volume of climate financing has resulted in the reduction of 12 million tons per year of equivalent CO2 emissions; the protection of 21,197 households against the risk of flooding; the construction of 75 kilometers of public rail and urban bus transportation systems; the improvement of the management of 10.4 million hectares of land and marine areas; and the generation of 4,400 megawatts of energy capacity from renewable sources.

About the IDB

The Inter-American Development Bank is devoted to improving lives. Established in 1959, the IDB is a leading source of long-term financing for economic, social and institutional development in Latin America and the Caribbean. The IDB also conducts cutting-edge research and provides policy advice, technical assistance and training to public and private sector clients throughout the region.

About IDB Invest

IDB Invest, the private sector institution of the Inter-American Development Bank (IDB) Group, is a multilateral development bank committed to supporting the private sector in Latin America and the Caribbean. It finances sustainable enterprises and projects to achieve financial results that maximize economic, social and environmental development for the region. IDB Invest works across sectors to provide innovative financial solutions and advisory services that meet the evolving demands of its clients.

About IDB Lab

IDB Lab is the innovation laboratory of the IDB Group. We mobilize financing, knowledge, and connections to catalyze innovation for inclusion in Latin America and the Caribbean. We believe innovation is a powerful tool that can transform our region, providing today unprecedented opportunities to populations that are vulnerable due to economic, social, or environmental factors.