The IDB offers different types of loans or instruments within this lending category and may be made for short-term, medium-term, or long-term needs. The size of the loan is based on the estimated cost of the project. Disbursements are made when the borrower submits proof of eligible expenditures.

Global credit loans provide financial resources to micro, small, and medium-sized enterprises (MSMEs) or subnational entities (such as cities and states) to finance projects in many sectors that promote economic and social development. The funding is indirect. IDB extends funding to first-tier private or public intermediary financial institutions, which in turn provides funding to second-tier public financial institutions (such as microfinance institutions), which then lends to MSMEs or subnational entities. The size of the global credit loan is determined by the expected demand for investments and the institutional capacity of the intermediary.

Examples of eligible activities include business loans that aim to increase the productivity of micro, small, and medium-sized enterprises; or urban development programs that strengthen the economy by encouraging the development of activities linked to tourism and culture

Loans based on results link disbursement of funds directly to the achievement of predefined, sustainable results. The aim is to help countries improve the design and implementation of their own (new or existing) development programs and achieve lasting results by strengthening good governance and fostering a management culture based on results. Such loans help shift the dialogue from day-to-day transactional issues to a broader and more enduring engagement between the IDB and borrowers.

Example of an eligible activity includes programs to encourage business innovation and entrepreneurship.

To see the policy GN-2869-10 “Proposal to Establish the Bank´s Sovereign Guaranteed Loan Based on Results."

This type of loan is designed to finance one or more specific projects for very specific purposes with interdependent components. By the time the IDB approves the loan, the project’s preliminary design, cost, and technical, financial and economic feasibility need to have been estimated.

A project is considered a specific investment if it cannot be divided up without affecting the nature of the project or the rationale for each of its independent components.

Examples of eligible activities include financing the construction of a hydroelectric plant, highway rehabilitation, sanitation improvements to protect a watershed, or upgrades in early childhood education.

Multiple works loans are more open-ended than loans for specific projects. They are designed to finance groups of similar works that are physically independent of one another and whose feasibility does not depend on the execution of any given number of the works projects.

Because not all subprojects to be financed by the loan are known by the time the IDB approves the loan, borrowers should specify a representative sample of subprojects before the loan is approved. This sample should constitute approximately 30 percent of the project‘s cost. While the project is being executed, individual investments are financed in accordance with the eligibility criteria specified in the loan proposal.

Examples of eligible activities include financing water and sanitation services in numerous rural areas that were not all identified before the IDB approves the project.

This facility aims to strengthen the preparation phase of a project, finance activities to help start projects before the first funds are disbursed from the larger loan, and lay the groundwork to make institutions more sustainable. The funds may also cover financing gaps for initial activities to execute the projects while necessary conditions (conditions precedent) are being met.

Example of an eligible activity includes preparation of a health loan to improve the quality of the health services delivery.

A reimbursable technical cooperation (TC) transfers the IDB’s technical know-how and expertise to strengthen the technical capacity of entities in developing member countries over the long term.

Examples of eligible activities includeprograms that support better implementation of national or subnational sector polices or strengthen institutional capacity of national and subnational entities; improve the quality of public investment by financing pre-investment studies for strategic projects in all sectors; or promote public-private partnerships.

This facility provides resources following a catastrophic disaster to cover a country’s immediate expenses to restore basic services to the population. Funding requires the existence of a disaster event of contractually agreed type, location, and intensity.

This facility helps cover immediate expenses incurred in restoring basic services to the population stricken by a natural and unexpected disaster.

Investment instruments can be executed with different approaches. A project that is structured using an “approach” can use any of the financial instruments available.

The Conditional Credit Line for Investment Projects (CCLIP) can finance programs involving one sector or multiple sectors and is expected to increase the agility of the processes to prepare and approve loans, reduce loan-processing costs; and reward borrowers for good performance in executing projects. By placing conditions on the credit line, the CCLIP supplies borrowers with timely resources, encourages them to execute the project well, and provides a vehicle to ensure efficient Bank support and continuous presence in the sectors of involvement. Click the title to learn more about this lending instrument.

The sector-wide approach (SWAp) aims at harmonizing project procedures among a government and its development partners in a single sector, strengthening the use of the country’s procurement systems. Funding arrangements can be pooled or non-pooled.

Explore our financing for private sector projects in Latin America and the Caribbean and other resources.

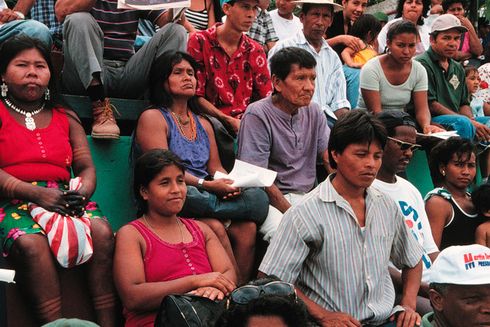

Learn how partnering with civil society organizations strengthens the value and sustainability of our work.