It has long been understood thatfinancial literacyandfinancialinclusion can increase household\'s financial resilience. That is especially truein times of economic crises, such as that of the current Covid-19 pandemic. People withfinancial skillscan better plan, save for retirement, and accumulate more wealth. Adept at modern financial technologies, like cards, apps and online payment facilities, they are also less likely to experience interruptions in basic services and inmoney flows, includingincome.

Given the vast importance oftheseskills, andtheiradded valueduring a time of extreme stress,the IDB has made a concerted effort to measure financial literacy in parts of the region where information on it is scarce. This includedasurvey onfinancial literacycarried outin Barbados in May/June 2020and more recently one in Suriname, which we describe, along with background in the following paragraphs.

The COVID-19 pandemic hasexacerbated Suriname’s ongoing economic crisis.The pandemicarrivedat a time when Suriname wasalready in a deepmacroeconomic crisischaracterized bytwin deficits(fiscal and current account),high double-digit inflation, high debtlevels,depleted international reserves,andbanking sector vulnerabilities. The social distancing and travel restrictions imposedby the countryto curb the spread of COVID-19 aggravated the precarious economic situationthrough job losses, business closures,loss of household income and otherhighlyundesirable impacts,such asreported increases in domestic violence.As a result, the quality of life of Surinamese householdsisbeing negatively affected.

Financial literacydata gapinSuriname.To address thedata gapon financial literacy in Suriname, the IDBincludedafinancial literacy module as part of a nationally representative telephone survey inthe country.The sample was drawn from the 2016/17 Suriname Survey of Living Conditions (SSLC), allowing us to explore theevolution of household’s characteristicsacross time.The survey wasconductedfrom April 16 to July 5, 2020andfeatured three financial literacy questions measuring the understanding of respondents on three fundamental financial concepts:1) interest rates,2) inflation,and3) risk diversification.The financial literacy score is defined as the sum of correct answers (out of the 3 questions). Then, individual-level scores are averaged to obtain the financial literacy index which ranges between 0 and 3.The use ofstandardizedquestionsthat have been applied internationallyenablescomparisons offinancial literacy performance across multiple countries.

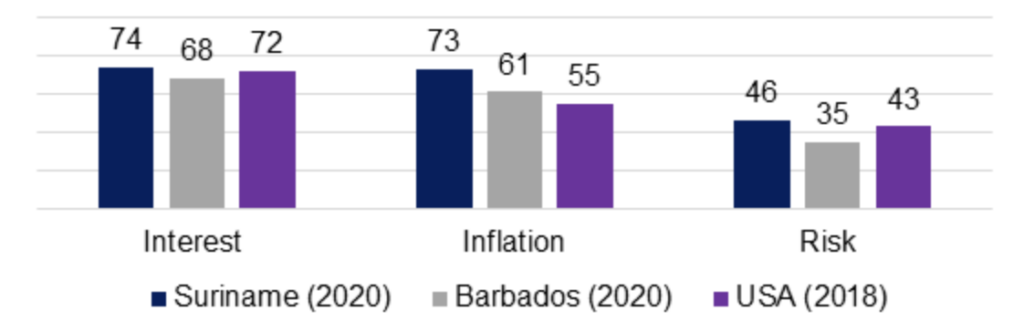

Financial literacy in Surinameisrelatively high at the national level, but there are differencesamongstdemographic groups.The results of the survey show that Suriname has relatively high levels of financial literacy by international standards. Thefinancial literacy index for Suriname is 1.92 compared to 1.65 for Barbados and 1.73 for the United States (USA). Surinamehad a higherpercentage of people providing the correct answer on all three questionsthan those countries(Figure 1).

Figure 1. Percentage Who Answered Correctly by Question and Country

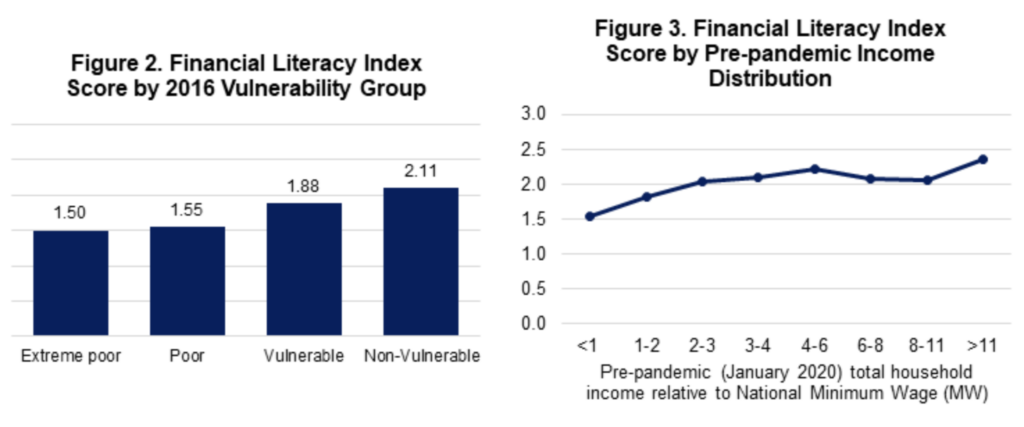

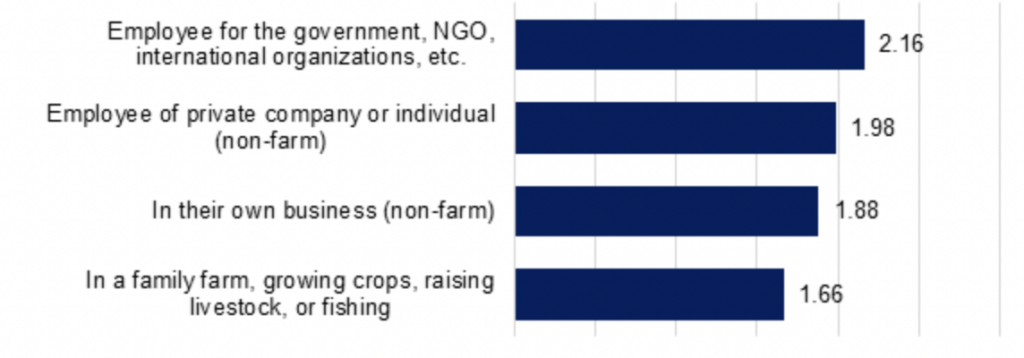

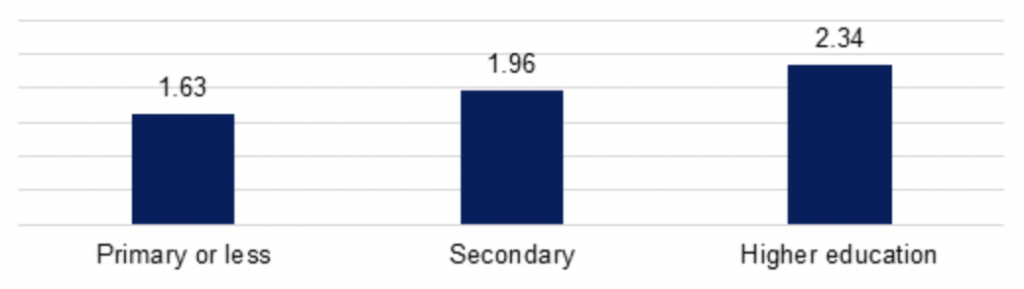

Even though Suriname’s financial literacy scores are high,there are significant differencesamongdemographic groups.Poor and low-income households score below more advantaged counterparts (Figures 2 and 3).Those that work in the agricultural sectoror areself-employedalsoscore relatively low on the financial literacy index(Figure4).Financial literacy levelsare positivelycorrelated with educational level(Figure5), andindividuals below retirement age have a higher financial literacy index score (1.98)thanindividuals 60 years old or older (1.79), particularly those 30to40 years old (1.99).

Figure 4. Financial Literacy Index Score by Work Sector

Figure 5. Financial Literacy Index Score by Education

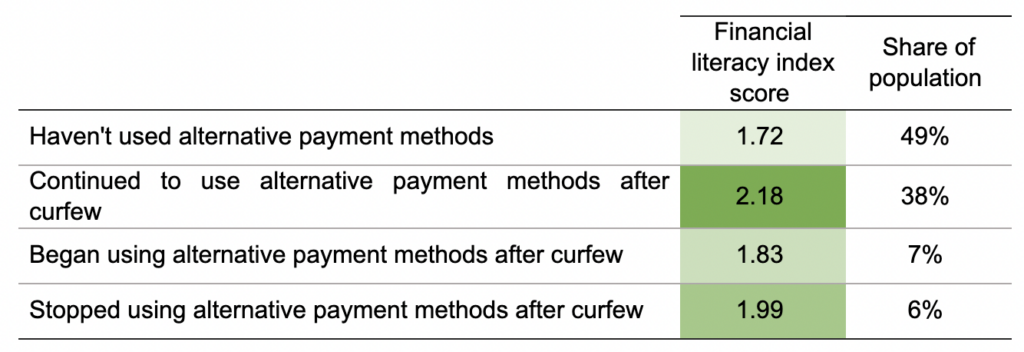

There is a positive association between financial literacy andthe usage ofalternative payment methods.The use ofalternative payment methods (cards, transfers, checks, apps,andonlinepayment facilities)becameincreasingly importantduring the pandemic.Households and businesses with limited access to digital financial servicesfacea higher risk of interruptionstobasic services andessentialmoney flows (wages, business sales, remittances, loan payments,government support,etc.).As shown in Table 1, households thathave consistentlyusedalternative payment methods are more likely to have a higher financial literacy index score. In addition, since the beginning of the curfew, 7%of householdshavebegunto usealternativeforms of payment.Theactivealternativepayment userbase, however,has notincreased:6%of households indicated theydid not use these services between March and June, even though they had previouslydone so. Possible reasons include:(i) an announcement that commercial banks stopped usingchecksin August 2020; (ii) withdrawal and deposit limits imposed by commercial banks since March 2020; (iii) anecdotal evidencesuggestingthat due to the COVID-19 restrictions there was an uptick in economic activity at small businesseswithlimited access to alternative payments options; and (iv)lower levels oftrust in the financial systemthat couldhave arisen due togovernance-related issuesin2020.

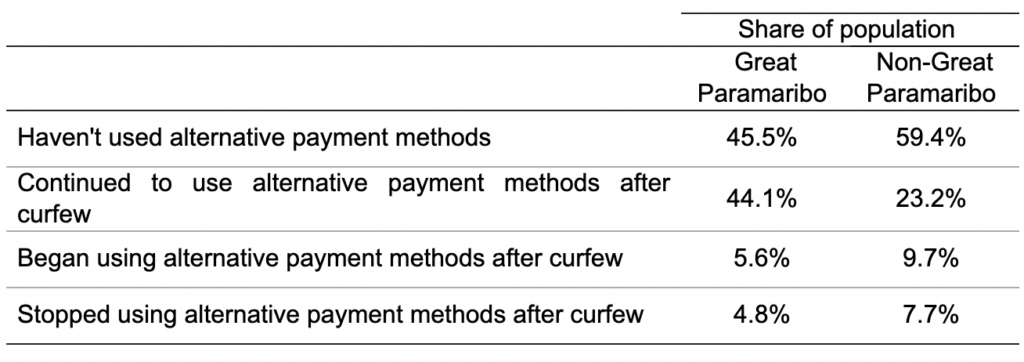

The share of the population that continues to use cash asitssole payment method is still considerably high, at49%.Theslow increase inuptake may be related toalack ofaccess to financial services,especially for vulnerable groups such as small and micro enterprises, those in the informal sector, and poor and rural communities,as well asinfrastructure andconnectivity constraints.As shown in Table 2, the share of the population that continued to use non-cash payment methods in the Great Paramaribo area was 44%,compared to 23% inthe non-Great Paramaribo area.

Table 1. Financial Literacy Index Score and Use ofAlternativePayment Methods

Table 2. Shareofthe Population by Use ofAlternativePayment Methods and Region

Note: The non-Paramaribo domain considers the Rest of the Coastal Region and Interior. Estimates for the non-Paramaribo domain have a smaller sample size due to the nature of the telephone survey.

Note: The non-Paramaribo domain considers the Rest of the Coastal Region and Interior. Estimates for the non-Paramaribo domain have a smaller sample size due to the nature of the telephone survey. Targetingfinancialliteracy initiativestokey demographic groups, addressing connectivity constraints andimprovingaccess todigitalfinancial servicescan helpimprovefinancial resilience, especially for poor households.The IDB surveycontributessignificantlyto the understanding of financial literacy in Suriname.The data allows us to better target efforts to deliver financial educationaswe can identifysectionsof the population that are still lagging.We observed a relatively slow increase inthe uptakeofdigital payment methods during the pandemic. Thismay be related to alack ofaccess todigitalfinancial services,gaps in banking and financial inclusion, and inadequate infrastructure as it relatestointernetpenetrationandareliable electricity supplyin some geographic areas of the country.Furthermore, although Suriname is often described as a "cash economy"with a relativelylarge informal sector,authorities are engaged inongoing effortsto improve financial education and financial technologies. Encouragingly, we observed that higher financial education is associated with greater use of alternative payment methods.The country should continue to accelerate efforts to improve financial education, targeted to vulnerable groups,andpromotedigital financial inclusion. Thiswill be critical to buildingfinancial resilience and supportingan inclusivesocioeconomic recoveryfor Surinamese households and businesses.